auto

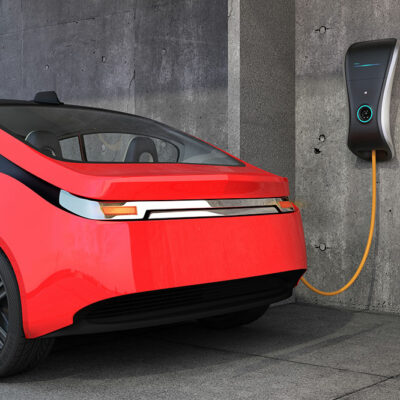

Top 3 budget-friendly electric cars

Electric cars are taking over the minds of many but not as much land in people’s garages. Part of the reason is the hefty price tag that comes attached to buying these green vehicles. Other smaller parts include the lack of performance as compared to old-school fuel-powered vehicles. However, technology keeps making advances, and there are some undeniably tempting options in the electric vehicles industry with some well-loved and preferred names attached to them. Here are some top electric car models and their prices 1. MINI Cooper SE Electric Hardtop MINI Cooper has been one of the favorites among many; it is only obvious that a green car version of the classic would appeal to the masses. For the lucky people eligible to have access to the federal electric car tax, the MINI Cooper SE Electric HArdtop comes at the price of $23,000; for the rest of us, the price lies at $29,900. The car comes with a user-friendly infotainment system, a single electric motor, and stunning exteriors. The charging time to get the battery to full capacity is 5 hours, and it delivers 110 miles of driving range. You can just as quickly charge the MINI at home with a 7.4KW outlet and five hours to spare.