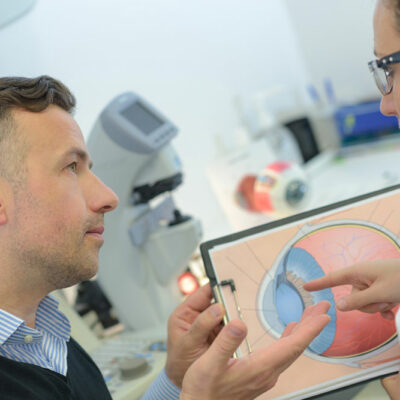

Macular

Macular degeneration – Foods to eat and avoid

It is possible to slow down and prevent the progression of age-related macular degeneration by altering nutrient intake. A meal plan rich in vegetables and fruits containing yellow, orange, and green pigments is recommended. Additionally, it is important to include omega-3 fatty acids in daily routine in addition to any ongoing treatments for dry macular degeneration. Studies have shown that certain minerals and vitamins can also help prevent macular degeneration. Foods to eat Colorful leafy vegetables Macula has antioxidants (carotenoids)—red and yellow pigments that guard the photoreceptor cells vital for vision. So, eating vegetables with carotenoids (mainly zeaxanthin and lutein) helps boost the degree of protective pigment around the macula and can slow or prevent AMD. To amplify the carotenoid intake with veggies, opt for bright yellow, dark green, or red ones. Some top options that can supplement dry macular degeneration treatments are collard greens, spinach, kale, broccoli, sweet potatoes, corn, and orange and red carrots and peppers. Nuts and seeds These are rich in vitamin E, which helps boost eye health. Among the nuts, the two best alternatives are hazelnuts and almonds. They have a high vitamin E content and can protect eye health because of their rich antioxidant benefits.